Before recording transactions, one of the first things to set up is the chart of accounts. That’s because it plays an important part in bookkeeping and acts as the foundation of a business’s financial system.

But what is a chart of accounts?

When recording transactions, such as sales and expenses, you don’t simply dump them into Xero and label them as “expense” or “income”. Each item requires very specific labels (accounts), and each of these accounts falls under one of five categories.

The chart of accounts is what we call the list containing all the accounts used by a business. It makes it simple to identify where items belong and keeps your books organised and tidy.

Account Categories

Think of your chart of accounts like a filing cabinet in your office. Each drawer represents a major category or type: Assets, Liabilities, Owner’s Equity, Revenue, and Expenses.

Accounts

In each drawer, there are labelled folders for specific accounts, such as Fuel, Repairs, and Tools. This way, everything has its place, and you’re not wasting time digging through a mess when it’s time to check your numbers.

The Assets drawer will contain information about everything your company owns. This will include cash, accounts receivable, and office equipment.

The Liabilities drawer will contain records of what the company owes to vendors or banks, such as accounts payable and mortgage loans.

Think of the Owner’s Equity drawer as your spot. The folders here show your share of the business or what’s yours after deducting what you owe from what you own. Things like when you put money in (owner’s capital) or withdraw money for yourself (owner’s draw).

The Revenue drawer will contain all records of the business’s income and its sources. For example, consulting, pipe repair, and drain cleaning.

Records of money spent on running the business will be kept in the Expenses drawer. This will usually have the largest number of folders. Examples include rent, telephone expenses, fuel expenses, meals and entertainment, software subscriptions, supplies, advertising expenses, and so on.

What is it for?

Say you want to record a payment you made to Facebook for ads. Suppose you’ve numerous folders in the Expense drawer. In that case, it can be a challenge to locate where to store the FB Ads receipt, especially if you can’t recall the number or even the name of the folder, or worse, if you didn’t label it at all.

That’s where the chart of accounts makes life easier. Each folder will be numbered and placed in the drawer where it belongs.

Now it’s time to create a chart of accounts.

The first step is to label the drawers (categories) with a number.

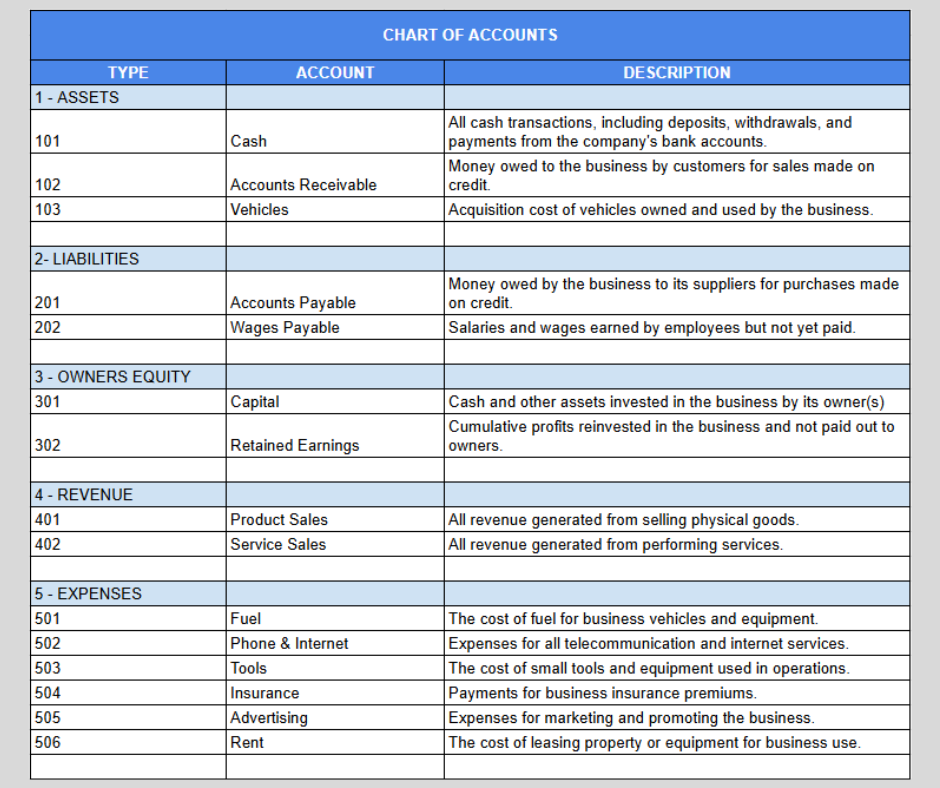

Now each of those folders will have a number that starts with the drawer number. Let’s see the illustration below.

Next, we’ll create a table that lists all the folder (account) numbers and names.

Notice that the table includes a description for each account. This is highly recommended as it will serve as a guide when sorting transactions as well as when checking accounts. Now, whenever we need to record something, we just need to look at the chart of accounts to know exactly where it should go.

Quick Tip

In the world of accounting, it’s common for asset accounts to be numbered in order of liquidity, or how easily they can be converted into cash. On the other hand, liabilities are typically numbered based on how urgently they need to be paid. This isn’t a hard rule, but it’s quite practical when it comes to reporting.

Summary

The chart of accounts is simply an organised list of all your business accounts, designed to make recording transactions more efficient and straightforward. When your financial records are kept in order, it’s much easier to get a clear view of how your business is tracking, and you’ll have cleaner, more accurate reports ready when you need them.

I hope I convinced you on the importance of a clean COA. In the next post, I’ll show you how to prepare your chart of accounts in Xero.

Cheers,

Val