The holiday haze is finally starting to lift. You’ve probably finished the last of the leftover ham, the kids are (hopefully) heading back to school, and the sound of power tools is back in the air. But for most Australian trade business owners, the real work is just beginning.

While everyone else is talking about “New Year, New Me” resolutions and green smoothies, January is actually a critical tactical window for your business. It’s that brief, quiet pocket of time before the Quarter 2 (Oct–Dec) BAS deadline hits on February 28th.

If you’re sitting down to look at your accounts this week, here is exactly what should be on your radar to keep things running smoothly.

The Great Glovebox Scavenger Hunt

Digital copies are no longer optional; they’re your best friend. The ATO isn’t exactly a fan of faded thermal paper from three months ago that’s been living under a meat pie wrapper.

Scour your inbox and your glovebox today. Use an app (like Dext or Hubdoc) to snap photos of those receipts. If you can’t read the ink, the ATO can’t either, and you can’t claim what you can’t prove.

The Super Deadline (Don’t miss this one!)

This is the one that catches people out while they’re still in holiday mode. Your Q2 Super Guarantee contributions are due by January 28th. Unlike a regular bill, you can’t just pay this one a week late and move on.

Missing this window triggers the Super Guarantee Charge (SGC) statement process. It’s a compliance headache involving extra forms, interest, and non-deductible penalties that you definitely want to avoid. Just pay it now and sleep better.

Chase the Pre-Christmas Ghost Invoices

Check your Aged Receivables, aka the list of people who owe you money. If there are invoices from early December still sitting there, don’t feel bad about chasing them.

Send a friendly “Welcome back to work! Hope you had a great break” follow-up today. A quick nudge now helps protect your cash flow for the month ahead and ensures you aren’t funding your customers’ holidays.

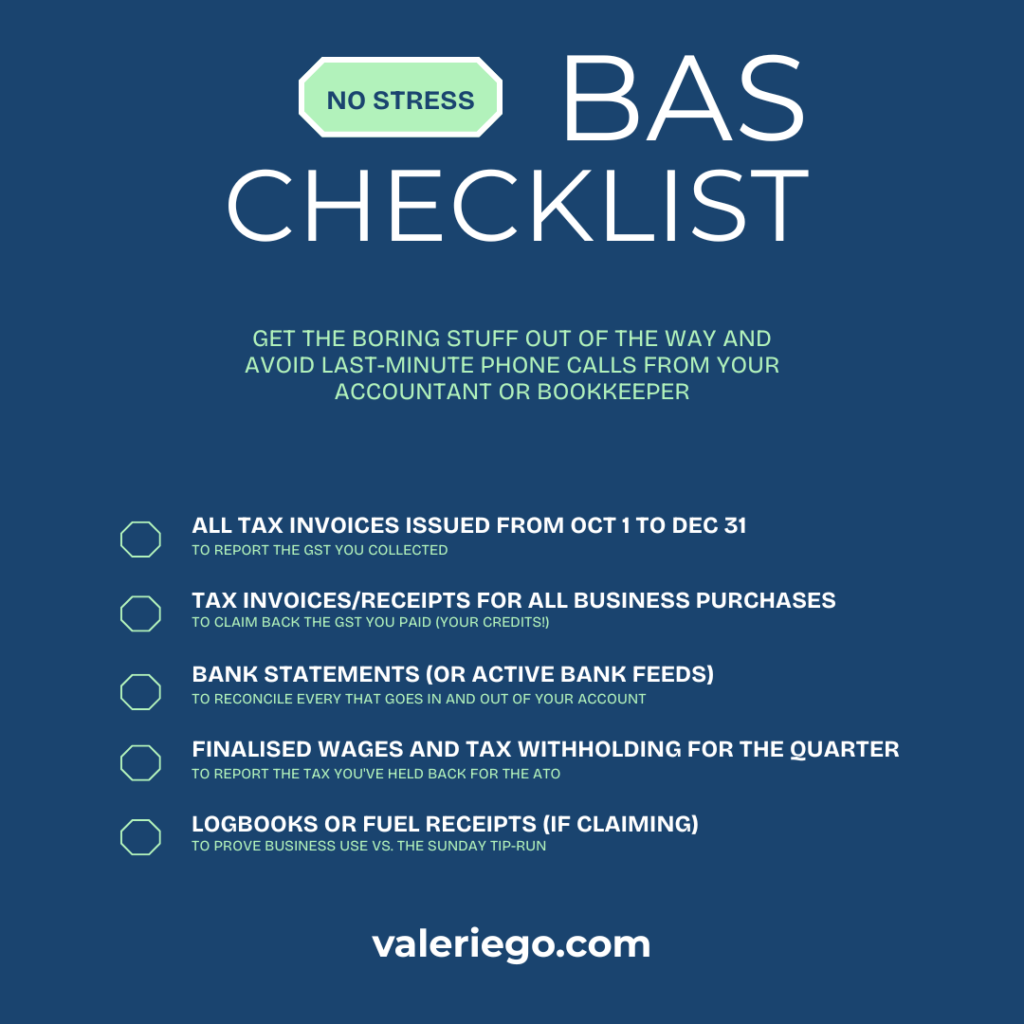

Your No-Stress BAS Checklist

To make life even easier, here is exactly what you, your bookkeeper or accountant needs to get that February BAS out the door without any glitches:

Why bother doing this now?

It protects your bank balance and avoids unnecessary stress. Taking an hour this week to tidy up the loose ends from December means you won’t be scrambling on February 27th right before the BAS deadline, trying to find a missing Bunnings receipt or wondering why your cash flow feels tight.

You’ve got enough on your plate, so let’s make sure stressing about your BAS isn’t one of them.

Need help with staying ATO compliant all year? Send me a message!

Cheers,

Val